📈 Getting started with financial investments - books and courses

April 28, 2024 • 4 min read

Initially, investing felt quite intimidating and it was something I kept putting off. I believed I needed a large amount of money to get started and the guidance of a financial advisor to help me understand the landscape. I wasn’t aware that I could begin with as little as 5-10 euros and that I could get the information from books, YouTube videos, forums as well as paid courses.

“An investment in knowledge pays the best interest.” Benjamin Franklin

At first, it all felt intimidating, and the hardest part was knowing how to get started. When seeking advice from someone already on this path, the information I received was overwhelming. The financial jargon was new and confusing to me. I believed I needed to find a broker, thinking this was a person that was needed in order to start to invest. Now, I realize that what I was seeking was a brokerage institution rather than an individual broker, who might charge high fees and not always get optimal returns.

Because I didn’t understand how investments worked, and my biggest fear was losing the money I had worked hard for, I thought it would be safer to leave it untouched. However, with inflation going up and information pointing to the fact that money left in a savings account would depreciate, I decided it was time to deep-dive into financial education. Reflecting on this journey, I realize it’s similar to any other learning process. By taking it step by step, dedicating a bit of time every day or weekly, I gained more knowledge which made it easier to take action. The most crucial step was simply getting started with the basics.

Ok, let’s dig into resources as this is what you are probably here for.

My recommendation is to start by familiarizing yourself with the basics through reading or watching introductory videos to understand the terminology and different instruments. Next, I highly suggest figuring out your risk profile and beginning with small investments aligned with it. Additionally, I recommend reading and watching shows on financial psychology as understanding our behaviors around money greatly influences how we save, spend, or invest.

Girls That Invest: Your Guide to Financial Independence through Shares and Stocks by Simran Kaur

A great book for understand the terminology and investment instruments. Example of people’s portfolio’s are shown at the beginning of every chapter to give you on insight how various people think about their investment strategy.

How To Get Rich - Netflix show

This is an easy-to-watch series where Ramit Sethi works with individuals across the US to help them achieve their version of a rich life. Participants openly share their bank account information, offering valuable insights into their income and spending habits. It’s an insightful show in whichdiverse couples with various income levels are featured, providing viewers with psychological and financial perspectives on wealth. This show will also make you think deep about what your rich life is about. The title might feel a bit misleading so don’t give it too much thought.

I Will Teach You To Be Rich - podcast

Also by Ramit Sethi, is a podcast that goes deeper into money psychology, a crucial aspect of finances. Similar to the show mentioned above, Ramit talks with diverse individuals who openly share their financial details, generating insightful discussions and a live coaching session. If you enjoyed watching the How To Get Rich show on Netflix, you’ll find interesting follow-up conversations with those cast members on this podcast. Here are some episodes I found interesting:

- 91. “I helped pay off his \$30k+ credit card debt and he didn’t even care” (Part 1)

- 86. “I make \$450,000/year from YouTube. My husband is ashamed he can’t match my success”

- 73. “I earn almost twice as much as my fiancé, but I make him split the rent” (Part One)

Get Smart With Money - Netflix show

This is a 1 hour and 30 minutes long documentary that’s best watched after you got some basic understanding of the various financial instruments. If you’re still unfamiliar with stocks/shares, index funds, bonds, etc., and have nothing else to watch on Netflix, it’s worth checking it out as you’ll still learn.

The show covers a wide range of topics, including budgeting, saving, investing, debt management, and even starting a small business. It features interviews with various financial experts who share their tips and advice. What I do like is that you also get to see people at different levels - in debts, rich, mid income etc. - and their financial challenges. For example Teez Tabor, an NFL cornerback, who earned a big signing bonus, and isn’t sure what to do with all this money 💰 given his short career as an athlete.

The Psychology of Money by Morgan Housel

This book will not teach you how to invest but the learnings and insights gained are priceless. I highly recommend reading this! As the author puts it in the intro of the book: “the aim of this book is to use short stories to convince you that soft skills are more important than the technical side of money.”

“The trick when dealing with failure is arranging your financial life in a way that a bad investment here and a missed financial goal there won’t wipe you out so you can keep playing until the odds fall in your favor.”

Additional books that are more on the mindset part:

- Unshakeable: Your Financial Freedom Playbook - Tony Robbins- at first I wasn't convinced but than I found great value in it and really liked the examples and the way it was written. Tony Robbins has another book on investment that I didn't check out.

- Tony Robbins: I Am Not Your Guru → Netflix show-: not only on money but good on motivation/mindset. 2 hours long and probably better than some not so good romantic comedy movies.

- Think Grow Rich by Napoleon Hill (book) → I am not a fan but I have gotten good insights from it. The jargon is all about men which obviously felt like a turn off but those were other times..

- Rich Dad, Poor Dad by Robert T. Kiyosaki (book) → meh, goodish but too much of is not actionable.

Bonus:

- How To Invest for Beginners: A good 20 minutes YouTube video from Ali Abdaal who goes into the basics of investments. He is good at explaining and you'll find more valuable content besides investments on his channel if you are interested in it. -> more like a short cut to some of the above mentioned resources or books

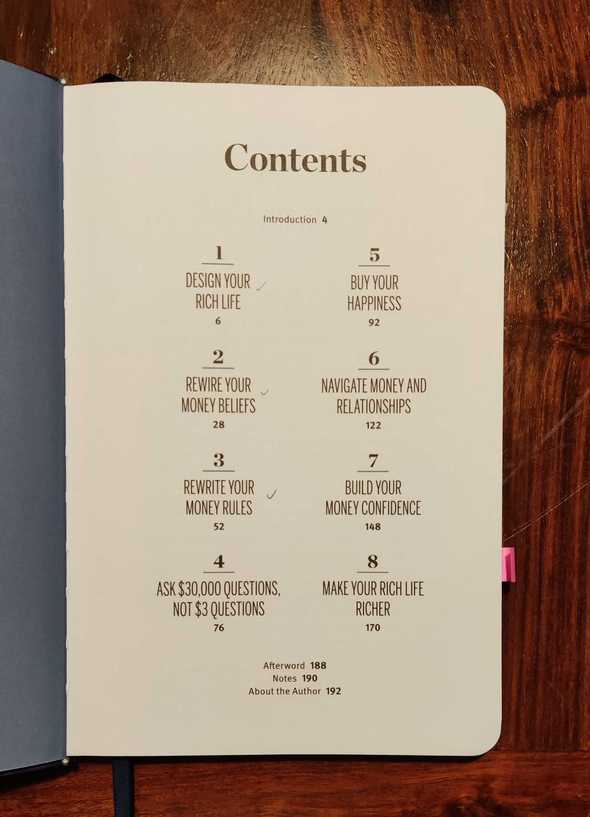

- I Will Teach You to Be Rich: The Journal by Ramit Sethi → helpful to plan out your life and reflect on your rich life. I personally got a copy of it and find it very useful and at times even hard to fill out as it really makes me think about my finances and current + future rich life.

- Rich AF: The Winning Money Mindset That Will Change Your Life by Vivian Tu: I haven't yet read this book. I started with it but left it for another time. The reason why I recommend this is because it comes from a minority's perspective and someone who didn't grow up rich. If you are curious to know more about the book before you get it I recommend checking this review by Gabor Javorszky.

- I asked a personal finance expert how to invest: (with Ramit Sethi): a 15 min long YouTube video in which Ramit shares more or less the same fundamentals as in his book or Netflix show but in a very quick to watch form.

If you are based in Europe check out this Reddit.

Things that were recommended to me that I partially consumed:

- Youtube channel → has good content but is more US & Canada centric.

- Spanish Youtube content → watched a few of this guys videos and I like how he explains things but some these apply only for spanish residents.

- Spanish Youtube channel → this guy also makes good content, but be aware that he throws in a lot of referral links and sometimes I'm not sure if those are the best choices. 🙈

Another resource in Spanish is the Bogleheads guide which you can also get in English somewhere online or maybe in a bookstore.

It’s good to do an Investment Risk Tolerance Quiz to know where you stand when starting. The most important thing is that you feel comfortable with what you decide to invest in and that you can sleep at night knowing you put your money in some stock or investment fund. I started slow putting little amounts in higher risk indexed funds and additionally got some smaller but fixed returns from bonds by the Spanish government. Everyone’s journey is unique.

Please also know that I watched way more videos on Youtube, read a bunch or articles, checked forums, and asked questions to people I knew would have some insights. I also took a Romanian course which I didn’t link as it’s all in Romanian and is more Romanian based.

If you have any recommendations let me know here. Thanks!

Disclaimer: This is not financial advice. When investing, your capital is at risk. Investments can rise and fall and you may get back less than you invested. Past performance is no guarantee of future results. Government taxes and fees apply."Read More:

Stefi Rosca

👩💻 Frontend Developer, 🌍 traveler and⛷️ Skier

Recurse Center Alumn